Edmunds just announced their Hackomotive 2014 contest where folks come up with ideas on how to improve the car buying process etc., and as a former employee I was initially excited to see this but within 60 seconds something caught my eye that was disappointing.

Last year's #1 Winner - My Motive which paints the picture that up until now the Dealer has made the consumer their "Bitch" yes, that's in there, and that this new My Motive lets the consumer turn the tables and finally make the Dealer their "Bitch" (yes it really says that).

Why does this bother me so much? We'll frankly because I was with them and helped launch their direct to dealer program and when I went to work there I remember in my interview saying: "I've been a dealer and for years we really haven't had much love for Edmunds so how are you going to fix that because, as a dealer, I need to know you're there for me if I buy your program."

My boss at the time shared the vision of Edmunds still maintaining their integrity with consumers but not really being focused on creating more content like 'confessions of a car salesman' anymore.

I bought into the idea that they would finally respect the dealer community and helped enroll well over 100 dealerships in their program in my first year with them.

Apparently I was wrong about their true motives and if all of this doesn't tick you off as a dealer, you need to get your head examined.

You can see the award of $10,000 they paid for a 1st place idea in hackomotive 2013 right here http://www.hackomotive.com/presentations/06_my_motive/mymotive.pdf

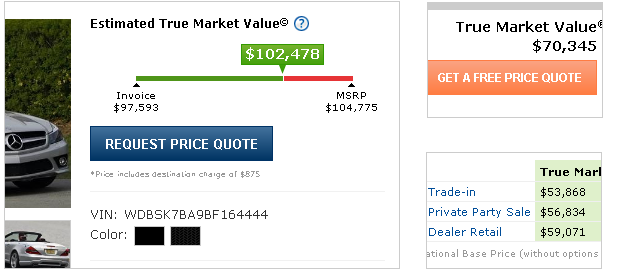

If you don't want to click over to their site, here are actual screen shots (Note - I've added the arrows and comments on the side)

In my not so humble opinion, vendors should work to help Dealers do two things: Get and Keep Customers. Rewarding a "Make the dealer my bitch" idea only furthers what many already believe about Edmunds.

Simply put, they don't care about your dealership, they only want your money and behind the scenes they're all still high fiving each other when they disrespect the dealer.

In this case, the high-five had a $10,000 bonus.

What's the best idea for 2014 going to be: "F@€K Dealers, buy direct from Edmunds" ?!?!?

I'd love to hear your feedback and please everyone, share this with other dealers ASAP but really I have a question for everyone seeing this:

ARE YOU DONE BEING Edmunds"BIT¢H"?

Helping the best get better,

Mat Koenig

CEO & Founder

KonigCo & iCarMedia

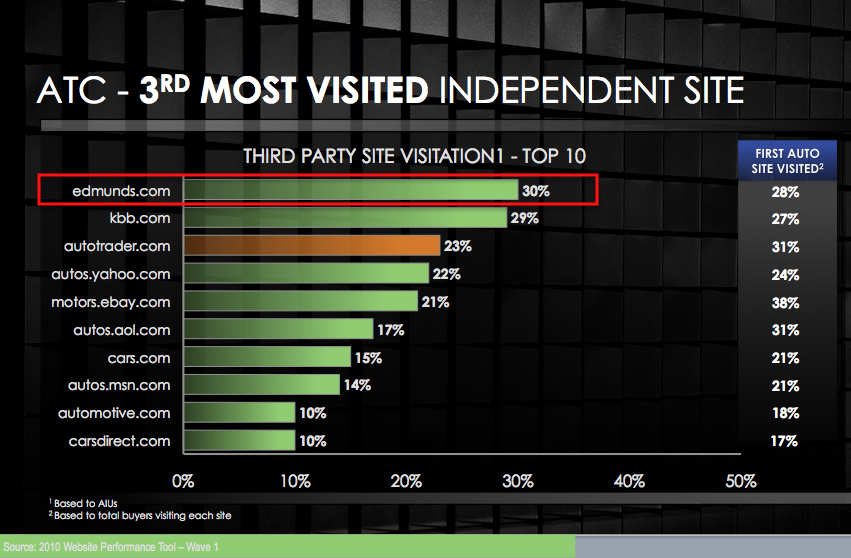

Dealers, WE/YOU have a very important choice to make that WILL help determine change (good or bad) to our industry. Keep in mind, Edmunds.com has never been one to

Dealers, WE/YOU have a very important choice to make that WILL help determine change (good or bad) to our industry. Keep in mind, Edmunds.com has never been one to