Google AIS Custom Search

car (380)

Jody DeVere

CEO

AskPatty.com, Inc.

www.askpatty.com/getcertified

Cell : 805-208-1008

eMail: jdevere@askpatty.com

Twitter: http://twitter.com/askpatty

AskPatty.com Certified Female Friendly®

www.certifiedfemalefriendly.com

Automotive Internet Sales and Google’s ZMOT for Car Dealerships

By now, nearly everyone has heard of ZMOT and how it might possibly be relevant for the automotive industry. In case you haven’t, ZMOT stands for “Zero Moment of Truth,” a concept developed by Google. It states that today, decisions on brand selection are happening before a consumer arrives at a store to make a purchasing decision. This also applies to how consumers shop for a car. This might not sound like anything new; we have all heard from NADA, JD Power & Associates, Cobalt, Autotrader and the OEMs that almost everyone goes online before they step into the dealership. Personally, I’ve been immersed in Automotive Internet Sales for more than 13 years. So, the fact that people are going online first isn’t a huge revelation — it is what it is. However, what has evolved is what is happening and why. People are finding out about a product or business (whether they know the URL or not). To be specific, more than 72 percent of all transactions start online, from one-dollar transactions to jet engines. The first place people go to is search engines (Google, Bing, Yahoo, etc.), or they may something on TV, radio, see something on a billboard or in a newspaper, magazine or hear about a product from a friend. In any event, they wind up on search engines relatively quickly. People believe that they will get the “real deal” on what they are looking for. “If it is on Google, it must be real,” they think. So, the consumer will do the initial research on the product or service online. That doesn’t necessarily mean they are accessing the Internet from a home computer or laptop. They can be accessing the information through their mobile device like an iPhone or Android. The next logical step for the prospect is to validate that information even further. Prospects can (and do) go to a myriad of review sites such as Google Places, Dealer Online Reputation, Yelp, Merchant Circle, Edmunds Dealer Reviews and Cars.com Reviews, just to name a few. The consumer wants to make sure that they do not waste their time with bad choices. They have access to too much information for them to have to deal with headaches. Take for example a couple choosing where to go eat out for their once a week “date night.” If you only had one time a week you were going out with your spouse because you have three kids, a puppy, a career, etc., try to imagine how someone will feel when they are spending $20,000, $30,000, $40,000 or more. That is why 80 percent of consumers say that peer reviews influence their buying decisions. An automotive purchase is usually the second most expensive thing the average human being will ever buy in their lifetime, next to a home. But there is another variable: social media. Consumers will also go to their social networks and ask their “friends and followers” thoughts, opinions on products or services before they ever go to the store or the dealership.

I am going to focus on online reputation for the rest of this article, and the next article I will dive deeper into the other parts of automotive ZMOT strategy.

Dealerships need to make it mandatory to collect client reviews and testimonials from both sales and service. It is not enough to simply “suggest” to your team to try to get a review or testimonial. You need to make it part of the standard operating procedure. You might want to create incentives for your team, for example:

• Whoever gets the most reviews wins a reward (gift card or cash, etc.)

• Whoever gets the most video testimonials wins a reward

You can create a mini-survey (maybe three to four questions) at delivery (mandatory). For example:

1. How would you rate your experience at the dealership from 1 to 5 (5 being the highest)?

2. Did I (sales consultant) exceed your expectations? If so, how?

3. What did you like (or appreciate) the most in this experience in purchasing this vehicle?

4. Would you recommend me and this dealership to everyone / anyone?

You should then have at the bottom of the survey a legal disclaimer (have an attorney draw up a simple disclaimer) that says that they (the customer) give you full permission to post (or use) this (review/testimonial) anyway and anywhere you want. By doing this, you can repost or repurpose all of these reviews to all of the relevant reputation sites like:

• Google places

• Merchant circle

• Yelp

• Edmunds reviews

• City Search

• Yellow Pages

• A review blog you’ve created yourself

It is TRUE that some review sites are IP Address specific and do NOT allow a client to post a review at the dealership, Here is the reality... there are a LOT of ways around that.

*** Please understand what I am saying here... I am NOT advocating using fake reviews or irrelevant reviews. I am saying ONLY to use REAL reviews that REAL clients give you and give you permission to use.

Try to image if every salesperson and service writer made 100-percent attempts to collect testimonials both in text as well as video, and you posted (syndicated) them to all of the relevant places online. In a short matter of time, you will be able to dominate the search engines with a ton of positive reviews.

I want to show you a quick example of a highline dealership that has bad online reputation. I happen to think they are an awesome store (and they are not a client). I serviced my brand-new vehicle there and I was so impressed with their service that I felt bad for their bad online reputation. On my own, as simply a customer, I shot a quick positive video review and posted it to YouTube and did the proper video optimization. Now, when you Google them, my video shows up prominently on the first page of Google (just Google “Cherry Hill Porsche”). That is just me as a client — can you image if this dealership did what I did? Their online reputation will turn around very quickly!

Here is another screen shot:

If you have any questions about this article, Google’s concept of “Zero Moment of Truth” / automotive ZMOT or how you can better equip your dealership (or individual sales consultant) to dominate with a positive online reputation, please feel free to call or e-mail me.

Sean V. Bradley is the founder and CEO of Dealer Synergy, a nationally recognized training and consulting company in the automotive industry. He can be contacted at 856-264-0564, or by e-mail at Sean@dealersynergy.com.

BY Andy Nicolaides on Fri March 02nd, 2012 iCar

(This is JUST FOR FUN :)

For a company with Apple’s huge wealth their product range is, when you look at it, relatively small. For Apple to continue its astronomical growth it is likely that they will have to expand their portfolio before too long.

Many believe that a move into the television market will be Apple’s next step, but what about beyond this? Will we see nothing but consumer electronics coming from “the worlds most admired company?”

Well according to iDownloadblog, Apple may well be moving into the automotive sector. At least that is what could be inferred from a recent job listing.

Apple is, apparently, in the market for an automotive engineer for an undisclosed project. The posting, filed two weeks ago under LinkedIn’s “Automotive” section is seeking a “new Product Integration supervisor” with knowledge of CNC machines and die casting.

A CNC machine is, according to Wikipedia, a computer numerical control device. This doesn’t help narrow down what is being worked on in the slightest, which is a bit of a shame!

A section of the job listing reads:

Apple (China) Looking for SQE/NPI with over 4 years Mechanical engineering background familiar with CNC/die casting/stamping/plastic injection, can use APQP/PPAP/SPC to control product quality.”

So what are the chances of us all driving around in an Apple iCar come 2015? Frankly, slim to none but its fun to dream isn’t it?

I would say the most likely result of this job listing, if it is genuine, will simply be iOS integration into future dashboard components or maybe Apple’s own GPS device. Either way I’m very interested to see where this will go.

Auto Dealers Build Trust by Personalizing Follow-Up Emails

http://www.drivingsales.com

http://www.dealersynergy.com

REPOST from DrivingSales.com Writen By Justin Braun. Auto dealers know the follow-up process is one of the most critical elements of lead conversion. This is especially true for leads generated through automotive live chat. To be successful in this business and build trust with consumers, dealers must follow-up with leads quickly and be precise and specific in their communication. For leads generated from automotive live chat, the chat transcript holds vital information about the prospect’s desires and how far along he or she is in the conversion funnel.

But, how can auto dealers be specific, personal and build trust in a timely manner?

Understandably, auto dealers hate to email out a price without first talking to someone. Dealers should simply focus on continuing to build the relationship with the prospective customer that was initiated by the live chat conversation while providing information that move the customer forward in the sales process.

In this blog, we analyze a real-life situation in which a dealer failed to follow-up appropriately with a chat lead. Then, we discuss appropriate and effective ways to follow-up with chat leads (and all Internet leads) so that they convert into sales and move forward in the sales process.

Below is an example of a failed follow-up process, straight from the chatter’s mouth…er, their fingers.

“Hello. Not too sure if you can answer my question. But how long does it usually take to get the bottom line price on a car? I originally inquired on 1.26.12 and then again yesterday. I have received the same auto reply/generic email thanking me for my interest.

Its okay. I just wanted to know if the manager would take the time to reply or if I should just forget about it and move on.”

Nothing is worse than spamming your leads with robotic, impersonal auto-replies. Something we stress to our auto dealer clients is to always be personal in your follow-up responses. As you can see from the last sentence of the chat, this ready-to-buy prospective customer has lost all trust is on the verge of giving up on the dealership.

So dealers, how would you salvage this situation and prevent it from happening in the future? Here are a few tips:

Send a personal email

A personal touch is all your prospects are looking for. It doesn’t have to be long – both you and the customer live busy lives – 3 to 5 sentences addressing the situation will salvage the sales process. Using the phrase, “My online sales assistant let me know you were interested in ______,” can be very effective. Fill in the blank and take it from there. Also, don’t forget to include a call to action. Never end an email with a statement! Conclude your email with a question to prompt a response.

Follow-up with relevant and specific information

Confirm special features/options on the vehicle ( something as simple as leather seats or advanced options like Bluetooth)

Confirm availability (and interior color and condition if it is pre/owned)

Send a pic of the actual vehicle and offer to send more

Give a bullet point of what the next steps are in the buying process

Explain advantage of buying from you

Remind the prospect of what is needed for the test drive( license, and whatever else they may want)

Provide info on what services or reconditioning on the pre-owned vehicle has been done

Read what is given to you

Read the chat transcript, form lead or any other consumer insights you have. Know what the customer wants and give it to them. It’s that easy! Remember that the chat conversation has already developed a relationship between your dealership and the prospective customer. An impersonal auto-response removes the customer entirely from the sales process and ruins your rapport.

By acting as an advocate in the follow-up process, auto dealers can provide consumers with information and then ask questions to assist them in moving forward through the sales process. Keep in mind that consumers don’t buy a car every day, week, month or year. Every “inside” tip you give prospects builds upon the trust already established by the live chat conversation.

Remember, the leads received through automotive live chat are a product of a two-way conversation. A template email saying thanks for your interest just stalls customers and erodes any trust built during a live chat conversation.

Remember, the leads received through automotive live chat are a product of a two-way conversation.

In addition to these tips, ActivEngage CEO Todd Smith offers additional advice that will not only help ensure auto dealers successfully transform chat conversations into leads, but will help them stand out in the marketplace during the critical follow-up process.

The Small Business Social Media Cheat Sheet

It is often said by the learned in the marketing field, that customers are not solely price motivated. This can be proven every day of the year, when people all around the world go to something we call “Convenience stores.” Think about it, when you're driving in your car, and that yellow light appears in your dash next to the red E, what do you find attached to nearly any gas station? ...Not a penny candy store. Furthermore, 7-Eleven…doesn’t have the best priced anything, but people still continue to flock to the establishment 24-7. I only say these things to help you understand the point…that (to 80% of people) price isn’t everything. I hope you are following me.

I don’t know about you, but I like to make money. Most business owners feel the same way as I. We can’t make money on a consistent basis if we constantly give our products away below market value. In our industry, we have one of two choices. We can either discount the vehicle, or build value in our 4Ps. (More on the 4Ps later.) I will admit that it is much easier to just go ahead and discount stuff, but to BUILD? Oh No! …That takes work! However, look at it this way; discount = less, value = more…are we motivated to benefit from the ease of less or the value of more?

Let's continue by discussing the term motivation. It is a process that elicits, controls, and sustains certain behaviors. Let’s begin with the end in mind…What is the behavior I’d like to elicit and sustain? Why... the purchasing of vehicles by potential customers of course. Wouldn’t it make sense to put a controlled process in place to create this behavior? Retail Businesses do it all the time. I got a coupon from Sears the other day for 10-50% off…I MIGHT use it IF it’s CONVENIENT for me…IF I need something from them in the time allotted. It is safe to say, that I am slightly motivated to shop at Sears when they want me to shop there. They have something in place to motivate/control my behavior.

Now…we could structure a deal with our customers for 10-50% off of vehicles, and still only experience a 20% increase in business. Another option is to sponsor a “BuildACar” campaign, or a “Onsite delivery to anywhere in the continental United States” promotion…and savor an altogether different business increase. What is the draw of a Car Show? Your dealership could host one once a quarter to boost sales another 20% because of the tactical information available to your customers.

All these are motivators:

- Build a car = Availability.

- Onsite Delivery = Convenience.

- A Car Show = Research.

And if your internet customers hate car salesman, then I suggest you change the way you do business…you can find three very easily executable proposals to do just such above.

This article actually was stimulated by a whole’nother thought/idea, nevertheless; creative thought bloomed. I sincerely hope that the words here are exercising your right brain as well…motivating you to sell more cars, more profitably, more often.

(Was that a stretch?) ☺

The internet sales team at Harnish Auto Family are a group of personal shoppers whose role is to provide you with a stress-free car shopping experience. To speak with a member of the internet team, call (888) 636-2381 or chat with us online at www.harnishautofamily.com.

As a brand new Internet Coordinator, one of the most daunting elements of my job is knowing the cars and the “car lingo.” I’ve never been very interested in cars in general, even though my father was not only a fantastic mechanic, he trained mechanics all over the SE United States for American Oil Company. I do have a marketing background, and I love helping people, so those aspects of this position are a perfect fit, but I have to work extra hard to learn the facts about the cars our customers are interested in.

In order to help me gather that information and to have it at my fingertips, I am compiling a database of info about the cars we sell. It’s in Excel, and I have a separate page for each type of vehicle. That way when a customer wants to explore SUV options, (or Trucks, Vans, or Cars) I have all those choices in front of me. I have columns for the current MSRP, the MPG, the pros (and some of the options), the cons, and comparable vehicles.

I’m no expert, and I’m finding that, at times, I misunderstand the data and enter it incorrectly, so it’s by no means the end-all and be-all of databases. In fact, if someone else has a great database that’s similar to mine, I’d love to exchange info with you! I can use all the input I can get!

But I am finding that with this information in front of me, when I have a customer that is truly doing research, I can provide much better assistance. I’m also learning the data much more quickly as I enter it into the database. Just the concentration and input I get from going through the research and entry process is helping me become more knowledgeable! It’s all good, and I can’t wait to feel more confident in providing facts for my customers and helping them make good decisions about the vehicles they end up purchasing.

Hey dealers, is your website equipped to out-perform competition this holiday season? Your 2011 holiday planning should already be well underway but there a few last-minute tips to get you in the spirit of closing sales from web leads.

Hey dealers, is your website equipped to out-perform competition this holiday season? Your 2011 holiday planning should already be well underway but there a few last-minute tips to get you in the spirit of closing sales from web leads.

Cyber Monday is a marketing term created by companies to persuade people to shop online on the Monday immediately following Black Friday. Between November 28 and December 31, a record number of consumers researching their next vehicle purchase will be visiting your dealership website.

Forrester Research predicted in its U.S. Online Retail Forecast, 2009 to 2014 report that the web would influence 48% of 2011 in-store sales, predictions which are set to come true. The average holiday shopper plans to do 36% of their shopping online – whether they’re comparing prices, researching products, or making a purchase (or an appointment to make a purchase). Data from Experian Hitwise indicates that website traffic increases in a troubled economy because buyers research purchases more carefully online to stretch shopping budgets.

Is your digital showroom (dealership website) ready for this spike in traffic?

To capture these leads, streamline your sales process and put your holiday marketing into high gear, try these tips:

1) Review online sales and customer-support options for better, more personalized service.

Integrating a live-chat option into your online sales strategy will help both you and prospective customers. Live-chat allows consumers to receive the full automotive shopping experience without having to leave the comforts of home. With the majority of consumers doing extensive research online prior to visiting a dealership, live-chat gives dealers the opportunity to engage website visitors in a personal sales process, answering questions, providing information and obtaining contact information. Live chat will save you time and money by transforming your already present website visitors into ready-to-buy leads and appointments.

2) Review last year’s SEO strategy

Which keywords sent the most and highest converting traffic to your website? This holiday season, create content and paid search campaigns with a high density of these best performing keywords. Drop the season’s worst performing keywords and determine which holiday-relevant keywords should be added. Doing so will maximize the findability of your dealership and inventory online.

3) Create a Mobile Site

Many holiday shoppers will be researching online and on their smartphones both before and during their trips to your dealership. Dealers would be wise to integrate the showroom experience with relevant, timely and personalized website and mobile app info. This can be done using QR codes that link to relevant videos, vehicle specs and inventory comparisons. Google is forecasting that 15 percent of total online search this holiday season will come from mobile. Dealers interested in quickly and cost-effectively building a mobile site should try out Google’s new GoMo initiative.

4) Ask for an email address wherever you can, both online and in-store.

Design an email strategy that includes holiday purchasing incentives and promotions. ”Email is still the king of Web marketing,” says Allison Howen, Associate Editor of Website Magazine. ”There are about three times as many email accounts as there are Facebook and Twitters users combined, according to a recent study from Smarter Tools.

5) Act fast to plug your leaky conversion funnel with split testing.

Use your web analytics to determine the pages on your website critical to conversion that have the poorest engagement. Use Google’s simple A/B Split testing solution to see how subtle changes to buttons and forms can make a big impact on your conversion rate. There’s no better time to start testing than now and there’s no more critical time to achieve your highest conversion than the holiday season.

6) Add social sharing to product pages to turn customers into sales channels.

Ask showroom visitors and customers alike to rate your dealership on your Facebook page (as well as other rating sites). Encourage consumers on the lot to check-in via Social and incentivize the sharing of photos and testimonials of their in-store experience. Keep your social profiles updated with holiday specials along with pictures and videos of inventory. Also, resolve customer service issues on Facebook or Twitter to publicly display your customer service chops.

Remember dealers, these strategies are not just for the holidays. Don’t stop just because it’s December 25. Take advantage of the last six days of the year by ramping up the promotion of year-end sales on your website and social media. Don’t forget to record your holiday season metrics too. They will come in handy next year.

When did you start your holiday season digital marketing strategy? Do you plan on implementing any of the mentioned strategies? What can you share with the online community that will help dealers be better prepared for next year?

Honda fights TrueCar's prices

Below-invoice online discounts frustrate some dealers and automakers

Honda, leery of brand-eroding discounts, has warned its dealers to stop offering prices below invoice on TrueCar.com and other Internet shopping sites.

The discounts jeopardize payments that Honda sends to dealers for local marketing, the automaker told dealers in October. Industrywide, the payments range from $300 to $600 for a $30,000 vehicle, one dealer said.

TrueCar is a leading player in the growing online retail industry that channels Internet leads to dealers. TrueCar CEO Scott Painter last week criticized Honda's position.

"They're trying to say Hondas are worth more than invoice, but if everybody's paying less than invoice, that's not true," Painter said.

The dispute highlights frustration among some dealers and automakers who say third-party Web sites such as TrueCar are eroding their power to set transaction prices.

TrueCar publishes recent transaction prices on its Web site and offers what it calls guaranteed low prices to shoppers. Dealers who sign up with TrueCar agree to pay the company $299 for each new vehicle sold from a TrueCar lead and $399 for each used vehicle sold.

Honda spokesman Chris Martin said that the automaker considers TrueCar an advertising medium. And Honda does not permit dealers to advertise prices below invoice, in part because it erodes Honda's brand equity. Dealers who do so jeopardize per-car payments from the factory under Honda's dealer marketing allowance.

But Painter said Honda is ignoring the realities of the marketplace, in which dealers compete aggressively on price.

In response to Honda's actions, TrueCar last week began warning Honda shoppers with a banner on its Web site that they might not get TrueCar's low price.

Upfront price guarantees are a key part of TrueCar's pitch to shoppers. And the prices listed for vehicles on TrueCar's Web site often are below invoice.

For example, a TrueCar search near Ann Arbor, Mich., for a 2012 Toyota Camry SE with automatic transmission and four-cylinder engine returned three guaranteed prices from local dealers, two of which were for less than the car's $22,075 invoice price. One dealer was offering the car for $21,875, another for $21,025 and a third dealer listed a car at the invoice price.

In TrueCar's terminology, the invoice is several hundred dollars above the cost of the vehicle to the dealer because the price does not include such factory payments to dealers as the holdback allowance.

Painter said Honda sales via TrueCar have declined since October because of Honda's warning.

He said the 278 Honda dealers under contract with TrueCar sold 2,389 vehicles in November. TrueCar's Honda dealers sell an average 8.6 new Hondas per store per month, and leads from the Web site generate 12.2 percent of the total sales volume of TrueCar's Honda dealers, he said.

"They could be doing twice as many sales through our platform than they are right now," if Honda revoked this policy, Painter said.

Painter was careful to add, though, that he was not picking a fight with Honda.

More clout

On Jan. 1, TrueCar's role in auto retailing will grow. That's when TrueCar becomes the exclusive online vehicle shopping partner for Yahoo.com. Traffic to TrueCar's Web site is expected to jump from a couple of million unique visitors per month to 20 million per month as a result of the deal, Painter said. Now, though, TrueCar leads account for a small slice of U.S. auto sales. TrueCar-participating dealers are expected to sell about 250,000 vehicles from TrueCar leads in 2011 either from shoppers on the TrueCar Web site or through agreements with more than 100 large associations, such as USAA and AAA. Painter said he wants to almost double the number of dealership franchises that participate with TrueCar to 10,000 next year and facilitate the sale of about 500,000 vehicles. USAA, a financial services association for military families, has asked Honda to reconsider its TrueCar action on behalf of its 8 million members who did 500,000 searches for Honda and Acura vehicles this year, according to a recent letter from David Bohne, president of USAA federal Savings Bank, to John Mendel, executive vice president of American Honda Motor Co. |

Protecting profit

The Toyota Camry SE: In Michigan offers of $1050 below the invoice price.

Mike Warwick, director of digital marketing for the seven-store Kelly Automotive Group in suburban Boston, agrees with Honda's policy toward TrueCar. "Honda's trying to protect the gross profit in selling a car and trying to protect the salespeople who are the backbone of the industry," Warwick said. Kelly, with a Honda store and two Nissan stores among its holdings, dropped out of its TrueCar contract this month after just three months as a participating dealer, Warwick said. In November alone, the group was inundated with 700 leads from TrueCar customers who took a guaranteed vehicle price that Kelly offered, he said. But the stores closed on just 20 of those deals and only three were profitable given the discounts negotiated, Warwick said. The vast majority of customers went elsewhere, using the deals negotiated on TrueCar to get lower prices for vehicles at other non-TrueCar dealers, he said. Meanwhile, Kelly had to follow up with all 700 customers, Warwick said. Few Honda dealers, he said, would be willing to risk their dealer marketing allowance for the additional volume that TrueCar can bring. Industrywide, that type of quarterly allowance is 1 to 2 percent of the sticker price for every vehicle sold, Warwick said. On a $30,000 vehicle, that would be $300 to $600. Other dealers, though, like TrueCar. Taylor Chevrolet in suburban Detroit is eager for TrueCar's tie-up with Yahoo to begin, said Jeff Kotlarek, Taylor Chevrolet's Internet sales manager. He gets about 15 new-car sales per month from TrueCar. He said Taylor Chevrolet offers vehicles to TrueCar shoppers at $100 below invoice and still makes money on the vehicles by upselling on warranties, accessories or additional options. The store sells about 175 new vehicles total per month. In a recent speech, AutoNation CEO Mike Jackson said of TrueCar: "The good deal that they're pitching to the consumer is lower than average. So to the extent that everyone goes with the TrueCar price, it moves the average down. "It's a death spiral, and the question is whether they are powerful enough to unleash that dynamic in the U.S. marketplace." AutoNation's COO, Mike Maroone, sits on TrueCar's board of directors, but neither he nor AutoNation has financial ties to TrueCar. Amy Wilson contributed to this report |

In their "Automotive Mobile Site Study", J.D. Power & Associates found that the use of smartphones for vehicle shoppers has increased exponentially. For example, they found that compared to 2010, those who used their smartphones to access automotive information increased by a staggering 40 percent.

Additionally, J.D. Power and Associates also found that 30% of male car shoppers use their smartphone when browsing for a new car. On the other hand, however, only 18% of women revert to their smartphone when looking to purchase their next car. Not surprisingly, the study also concluded that collectively shoppers 40 years of age and younger use their smartphone 26% of the time, while those 40 years of age and older only use their smartphones 21% of the time. It doesn't stop at smartphones, however.

Thanks to the emergence of tablet devices such as Apple's iPad and Blackberry's Playbook, vehicle shoppers aren't limited to just using their smartphones. During their study, J.D. Power discovered that many vehicle shoppers used a tablet device (iPad, Playbook) to access automotive websites. Men used a tablet device 22% of the time, while women only used a tablet device 16%.

Arianne Walker, director of Automotive research at J.D. Power & Associates had this to say following the study: "While the proportion of vehicle shoppers who use smartphones to visit the Internet during the shopping process is still relatively small, it is expected to continue to grow during the next several years, which will shape the way automotive marketers will need to design their mobile sites and apps."

If you're still not convinced that smartphones are changing the vehicle buying process, take this into consideration: the 40 percent increase in automotive website visitation on smartphones is greater than the use of gaming (27%) and social media (17%).

As more and more car dealerships move their attention towards smartphone shoppers and invest in their own mobile app, the number of smartphone vehicle shoppers is only going to increase.

What do you make of this study?

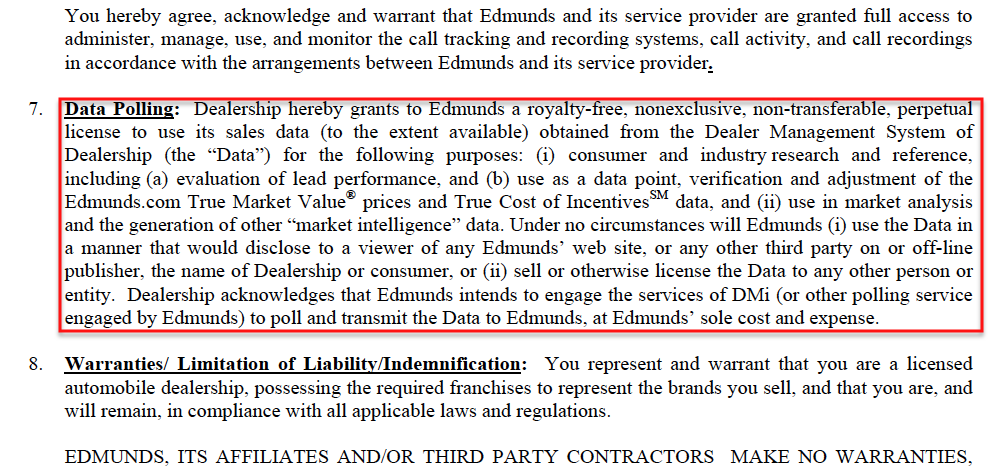

As you know or if you’re not already aware, Edmunds.com is going direct to dealers. They’re cutting out the middle man (AutoUSA, Dealix and Autobytel) and coming after our business with a newly hired sales team.

Dealers, WE/YOU have a very important choice to make that WILL help determine change (good or bad) to our industry. Keep in mind, Edmunds.com has never been one to treat the dealer fairly.

Dealers, WE/YOU have a very important choice to make that WILL help determine change (good or bad) to our industry. Keep in mind, Edmunds.com has never been one to treat the dealer fairly.

I’ve been watching this for a while, and it’s not rocket science, but follow me…

A few years ago, Zag is re-selling leads to dealers per lead basis. Zag changes their subscription model and starts charging dealers on a per sold basis.

“So I don’t pay unless I sell a car?” – nope. That is music to a dealer’s ears!

However, in order to determine what to charge you, Zag needs access to your DMS in order to match-up customer sold data (dare they say “transactional data to the dealer”) with the leads they’ve sent you over the last few months.

Dealers don’t think twice about signing up for the new Zag subscription model. But not thinking twice is the potential issue. You just signed an agreement allowing a 3rd party company to proudly scrub your DMS for YOUR transactional data! Only to use this data to power a CONSUMER facing price analysis tool – TrueCar!

TrueCar Inc. is an automotive solutions provider focused on changing how cars are sold by providing a significantly better customer experience while helping qualified dealer partners to gain incremental market share and reduce costs. TrueCar.com is a transparent, visual publisher of new car transaction data.

How much more transparency does our business need? Perhaps this is nothing more than the evolution of our business.

I’ve spoken to several higher-ups at TrueCar and trust me, this is a determined company. They “want to change the way cars are sold and bought”. Yeah, we’ve heard this before, but this time we dealers need to listen and pay attention.

The challenge; how does TrueCar turn TrueCar to be a household brand?

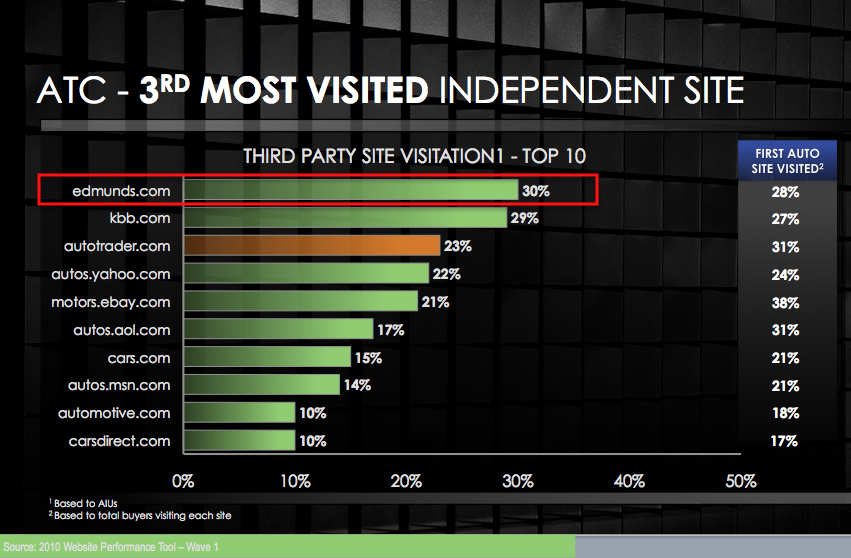

Let’s review the top visited online automotive research sites …

In order for TrueCar to become a household name, they need a platform to brand themselves. Edmunds.com fits the bill.

Before I go any further, allow me to inform you the following is pure speculation on my part… ![]()

TrueCar’s people speak to Edmunds people about a possible synergy between the two. They consider a deal UNTIL Edmunds.com say “Whoooaa – wait a second, we already have a TrueCar piece and it’s over a decade old”. TMV – True Market Value.

For sure you haven’t forgotten about TMV have you?

Edmunds.com quickly figures out exactly what they need to do. Sell direct to the dealers. And in return suckering dealers into allowing them to pull their transactional data.

Click here for a copy of the Edmunds.com Dealer Agreement For Dealers.

TrueCar already claims to have over 40% of all transactional data In the United States. Dealers allowed this to happen due to our ignorance and oversight.